This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

ePrior Authorization’s Real Benefits: Reducing Frictional Costs and Speeding Time to Therapy

- April 27, 2019

- By Jeanette Nelson

- 0 Comment

Authors: Ken Kleinberg, Jocelyn Keegan, Tony Schueth, Michael Solomon

Healthcare is complex and electronic prior authorization (ePA) is one very visible component being shaped by tensions between various stakeholders, changing standards and forthcoming regulations.

Point-of-Care Partners leveraged our unique perspective and relationships in the market with payers, providers, life sciences companies, and the stakeholders supporting them to create this new and comprehensive report. Our experts brought their extensive experience with ePA, ePrescribing, medication management, and transactions in support of value-based care together with industry interviews, in the writing of this report designed to bring your team up to speed on the ePA landscape with an in-depth analysis of what the future may hold.

How does this report help you?

This report contains invaluable information for organizations who want to stay ahead of industry changes through smart strategic planning. This report not only contains in-depth analysis but translates it into actionable advice to consider regarding ePA – such as

- Which standards bodies to rely on and advance – there are many competing, parallel, complementary, and emerging approaches to standards which can make it difficult for any size organization to choose

- How to comply with current and expected regulations – not all organizations can support lobbyists or be leaders in standards efforts and forthcoming regulations will affect all stakeholders

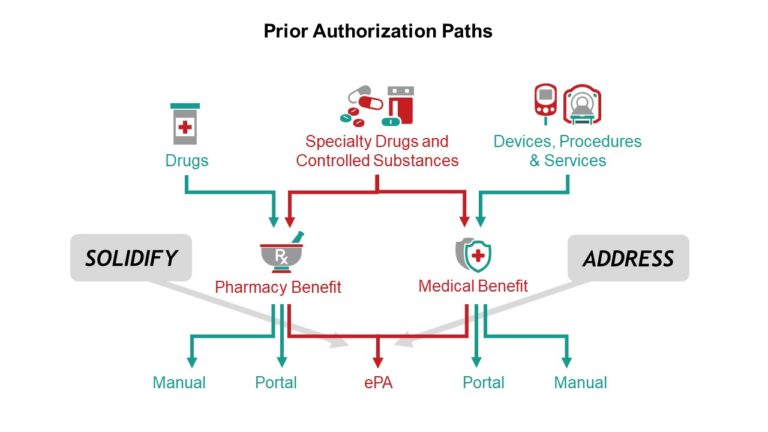

- To what degree to invest in medical benefit ePA – while solidifying the path to pharmacy benefit still requires work, this issue of how much attention to provide to the medical ePA is one of the largest to consider – the rewards may be great, but the resources and risks are still high

- Whether and with whom to outsource ePA – the rise of mini-services, Service-Oriented Architectures, the value of ecosystems (marketing, plug and play, lower initial cost outlay, time to market), and the ability to more easily scale are all reasons to consider this option

What does this report contain?

A preview of the report that highlights the full table of contents is available, however, you’ll find the report focuses on the following areas:

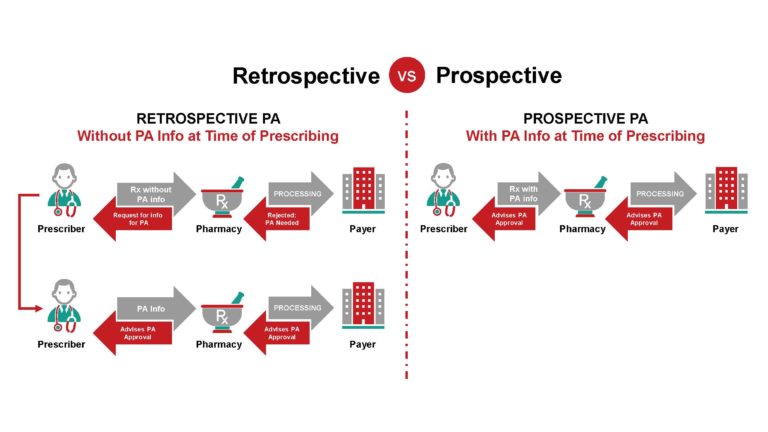

- Current market conditions and market drivers for ePA, including analysis of the differences of ePA adoption (and why ePA in many areas has stalled), opportunity, and return on investment between regular and specialty medications (and why they should be such a high focus), and between pharmacy vs medical benefit (and why they should come together).

- Required ePA technical components, including integrated workflow vs portals, and interoperability/transaction standards, including the current and future use of X12 (and why the 278 has been a hinderance), National Council for Prescription Drug Programs (NCPDP) Script (and why it has been so successful), and evolving Health Level 7 (HL7) standards such as Fast Healthcare Interoperability Resources (FHIR) (which shows substantial promise), the CDS Hooks API using FHIR and their relationship to real-time benefit check.

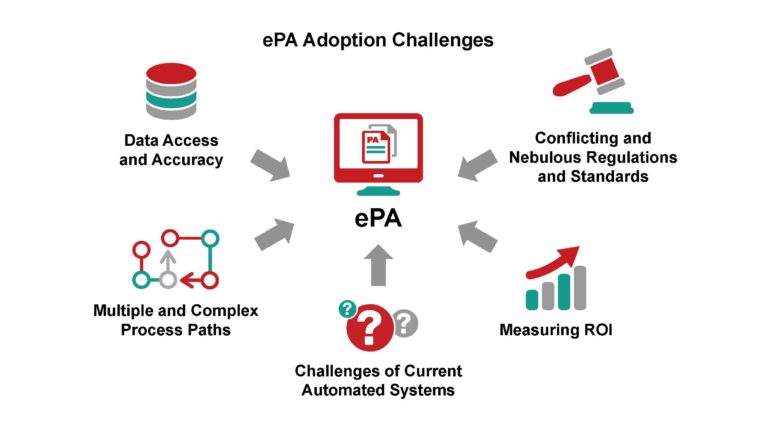

- An ePA maturity model to help advise organizations where they are and what they need to do to progress to the fourth stage, the ideal ePA; adoption challenges of ePA; multiple ePA cases studies; and lessons learned.

- ePA vendor profiles featuring the most comprehensive list ever compiled of more than 40 representative and leading ePA ecosystem vendors segmented by their primary ePA focus into seven categories: specialty/intermediary ePA, payer and utilization management (UM), ePrescribing network, clinical content, PBM, EHR, and Revenue Cycle Management (RCM).

- Case studies that provide examples of PA approaches, results and next steps

- A future ePA outlook, including the impact of artificial intelligence/natural language processing, use of blockchain, which regulations will have the greatest impact (including views on proposed critical CMS and ONC regulations), and what it will take to reach a seamless future of provider/payer convergence.

- Specific, actionable advice for payers, providers, converged value-based entities, vendors, and other key stakeholders to drive ePA success.

ePA Solutions Ecosystem Profiled Vendors

| PBMs | INTERMEDIARIES | EHRs | RCM | CLINICAL CONTENT | ePRESCRIBING NETWORKS | PAYERS/UM |

|---|---|---|---|---|---|---|

| Cigna/Express Scripts | Anthem/AIM Specialty | Allscripts | Availity | Change/InterQual | Allscripts/Veradigm | Agadia |

| MedImpact | Asembia | athenahealth | Infinx | Hearst MCG | DrFirst | Cognizant/Trizetto |

| Optum/OptumRx | CenterX | Cerner | Recondo | Wolters Kluwer | Surescripts | CVS/Novlogix |

| Prime Therapeutics | CoverMyMeds | eClinicalWorks | ZappRx | Hearst/MHK | ||

| and 1 other | and 10 other companies | and 5 others | and 1 other | and 2 others |

ePA vendor profiles featuring the most comprehensive list ever compiled of more than 40 representative and leading ePA ecosystem vendors segmented by their primary ePA focus into seven categories

Some of what you’ll see in this comprehensive 107-page report:

1. Understanding the Many Different PA Paths

2. ePA adoption challenges and how to address them

3. Identifying the greatest short and longer-term opportunities for ePA

Want to learn more? Set up a one-on-one meeting to discuss how this report may help your organization by calling us at 877-312-7627, option 4 or dropping us an email at info@pocp.com.

Jeanette Nelson

A Point-of-Care Partners Analysis, Trends, and Action Report

POCP’s Research Reports provide strategic insight and analysis on key healthcare topics and trends. Compiled by our experienced analysts and practice leads, all reports are available for download in PDF format. If you need a more customized summary of a health IT topic or industry trend, contact us.

ePrior Authorization’s Real Benefits: Reducing Frictional Costs and Speeding Time to Therapy

ePA is a key approach to ameliorating some of the unintended consequences of prior

authorization through automation. Our goal with this report — our most extensive ever (with

40+ diagrams and tables, and 90+ references) — is to offer healthcare stakeholders an

independent analysis of the market, realistic maturity models, and a profile of what vendors

and service companies are currently doing around ePA so they can arm themselves with the

information needed to plan strategically and meet their goals.